If you landed here because you typed “What is Crypto?” into a search bar, you’re in the right place. I’ve taught digital finance topics for years, and I’ve seen students walk into the classroom confused, intimidated, or convinced crypto involves magical internet money created by mysterious tech wizards. Spoiler alert: it doesn’t. Well… not entirely.

Today, I’ll break everything down in a way that feels structured, academic, and reliable—while still keeping things human. I’ll even add a little sarcasm here and there to prevent this from sounding like a sleep-inducing lecture. Ready to understand cryptocurrency with actual clarity? Let’s begin.

Defining Crypto: Getting to the Main Point

When someone asks, “What is Crypto?”, we generally think they want a straightforward explanation, to cut through the clutter. Here you go:

Crypto is a type of digital currency secured by cryptography, rather than by a government or a bank.

That’s the basic definition. But I know what you’re thinking. you’re saying “Okay, but what does that actually mean?”.

Cryptography secures the system to ensure every transaction is secure, verifiable and almost impossible to change. If this sounds science-fiction-level technology, it is! But there is nothing to worry about, FYI. High-tech does not mean unreachable and if it did, half the internet would not work*.

Crypto exists 100% online. You will not hold it, fold it or lose it in the couch. Instead, you will store it in digital wallets.

You all with me? Great!

Why Crypto Even Exists

Why did people create cryptocurrency in the first place? Because they wanted:

- A financial system without banks controlling everything

- Faster global payments

- Lower fees

- Transparent, tamper-resistant records

- Digital money that anyone could access

Ever felt frustrated waiting three business days for a bank transfer? Crypto developers felt that frustration too—and they decided to do something about it.

The Functionality of Cryptocurrency

Let’s go further; we promise to keep this fun (we think)!

Cryptocurrency operates depending on a few core principles, and having an understanding of these principles allows you to develop a solid foundation in the basics of Digital currency!

1. Blockchain Technology

Blockchain is the “foundation” of crypto; it essentially works like a digital ledger… or a fancy, encrypted notebook, in a sense—with a record of every transaction in a permanent chain in time sequence.

- Here’s a look at how it makes this secure:

- Every block contains data about transactions.

- Each block “links” to the block prior to it.

Participants in the network confirm transactions based on complex calculations.

If someone alters a block within the chain, it will get rejected by the entire network. It’s kind of like trying to add a fake page to a library book while being watched by an omniscient librarian in 4k!

This process will start to make sense when we describe the keyword: Understanding blockchain.

2. Cryptography

Cryptography ensures two things:

- Only the owner of the crypto can use it

- No one can fake a transaction

Think of cryptography as the ultra-strict gatekeeper who checks IDs, permission slips, and proof of residency before letting anyone through.

3. Decentralization

Traditional money flows through banks and governments. Crypto removes those intermediaries and relies on a network of computers called “nodes.”

No single entity controls it, and that’s the whole point.

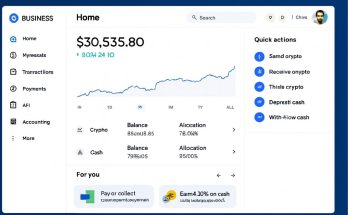

4. Digital Wallets

Your cryptocurrency stays in a digital wallet, which stores your private keys. These keys prove you own your assets.

Lose your keys, and you lose access. True story. And yes—people have indeed lost millions this way. Painful lesson.

5. Mining (or Validating)

Many cryptocurrencies rely on computers that validate transactions by solving complex puzzles. These validators earn rewards in the form of crypto.

Imagine getting paid for doing math. Some of you might faint at the idea, but miners love it.

Types of Cryptocurrencies

You’ll encounter thousands of cryptocurrencies, but they generally fall into several core categories. Understanding these helps you gain better insight into Types of cryptocurrencies.

1. Bitcoin (BTC)

Bitcoin was the first cryptocurrency. It remains the largest, most recognized, and most valuable digital currency.

People call it “digital gold,” which sounds dramatic but accurate.

2. Ethereum (ETH)

Ethereum introduced programmable contracts called smart contracts—automated agreements that run by themselves.

Think of it as a vending machine. You put in your money, press a button, and the machine completes the transaction without human involvement. Except Ethereum’s contracts can handle more complex tasks than delivering Cheetos.

3. Stablecoins

Stablecoins tie their value to something like the U.S. dollar. They aim to provide stability (shocking, right?) in a volatile market.

4. Utility Tokens

These give access to services within a specific platform. They’re like digital tickets.

5. Meme Coins

Created as jokes… and sometimes worth billions. Humanity is fascinating, isn’t it?

Why People Use Cryptocurrency

Students often ask me: “Why do people care so much about crypto?”

Here are some reasons:

- Lower fees for sending money globally

- Faster transactions

- Financial independence without banks

- Investment opportunities (sometimes risky, sometimes rewarding)

- Access for people without traditional banking

These factors make crypto especially appealing in regions where traditional banking systems struggle to provide reliable financial services.

Beginner’s Guide to Crypto: Where to Begin

If you are completely new to the sector, here is a pathway for Crypto for beginners.

Step 1: Begin With The Basics

Start with the basics:

- Blockchain

- Wallets

- Transactions

- Private keys

- Public keys

The same way you don’t begin to drive by simply jumping into a Formula 1 race car, you shouldn’t begin crypto without the basics.

Step 2: Pick a Good Exchange

Choose reputable exchanges with good security features. Look for:

- Two-factor authentication

- Regulation figures

- Good user reviews

- Fees and other costs processes are transparent

If the exchange promises assured returns, run. Seriously.

Step 3: Set Up and Protect Your Wallet

Use:

- A software wallet for ease of use.

- A hardware wallet for optimal security.

Always back up your keys. Write them down on paper and store them offline. Do not take screenshots unless you enjoy living on the edge.

Step 4: Get Started with a Minimal Investment

Make small purchases while you allocate more funds for yourself. No need to go “all in” since this isn’t a casino movie.

Step 5. Watch the Market

Crypto moves fast – use reliable tools, read charts and learn as much as you can. Knowledge is always better than luck.

Digital Currency Basics Every Student Should Learn

Lets point out a few digital currency basics every student should master.

- You Can’t Reverse a Crypto Transaction

Once you send it, it’s gone. There is no “I accidentally sent it to the wrong person” recovery.

- Crypto is Not Anonymous:

It’s pseudonymous. Your identity is hidden but the transaction is transparent on the blockchain.

- Not All Cryptos Are Created Equal.

Some are the products of years of research, others are memes. Understand what you’re investing in.

- Regulation Is Changing

Governments around the world are working on crypto laws. These apply to trading, taxation, and usage.

Common Misunderstandings about Crypto Currencies

The following are some of the major misunderstandings to clear up:

Misunderstanding 1: “Crypto Is Just for Criminals.”

Truth: The vast majority of crypto transactions are legitimate. Criminals have always preferred cash, because it’s much harder to trace.

Misunderstanding 2: “Crypto Has No Real-World Use.”

Truth: People use crypto for payments, investments, cross-border transfers, smart contracts, decentralized applications, etc.

Misunderstanding 3: “Crypto Is Too Complicated.”

Truth: Once you understand the basics of blockchain, everything else is easy.

Misunderstanding 4: “Crypto Will Replace All Government Money.”

Truth: Crypto is an innovation to improve the benefits of fiat currency, not a replacement of government fiat money.

The Future of Cryptocurrency: What Can Students Expect?

The crypto space is still advancing, and it is not slowing down anytime soon. You should expect:

- More government regulations

- Blockchain industries will be growing

- More use cases beyond the real world

- Advanced digital identity systems

- More applications with dollars

We can say that does this mean that crypto will be the currency of the planet? Probably not. But we are beginning to see the way it will change finance.

Conclusion: So… What Is Crypto Actually About?

When someone asks you “What is Crypto?“, you will feel confident to say it is secure digital money based on a blockchain, designed to give people control, and allow faster exchanges, as well as new tools in finance.

- You now understand:

- How cryptocurrency works

- Varieties of cryptocurrencies

- Why people are using cryptocurrency

- Basic safety principles

- Beginner actions to get started

It may seem complicated at first, but once you understand the basics, it becomes clear that it is just a new tool to make the financial system more accessible.

And if you still feel a little confused – do not worry. Each expert was a beginner once. Keep exploring, continue to be curious, but just remember: knowing the crypto space will put you in a good position in the digital economy.