Let’s face it – stock-picking sites are abundant nowadays. Every website says, they have the next “Tesla” or it is the “safest dividend stock of 2025.” When I came upon 5StarsStocks.com and they said they had “top-performing picks,” and “underrated gems,” my curiosity (and some skepticism) went into motion.

I figured I could do worse than give it a legitimate try, so I put 5StarsStocks‘ “Top Picks” to the test for a whole month and what happened next was quite honestly surprised me.

What Is 5StarsStocks.com Anyway?

If you have never heard of it, 5StarsStocks.com, is a stock-picking site that chooses the best stock picks in as many categories including AI, 3D printing, and dividend stocks. they advertise themselves as both a research hub for newbies and savvy investors by picking stocks in:

- companies driven by AI and tech (think next-gen innovation stocks)

- 3D printing stocks for the futuristic audience

- value stocks for the conservative audience

- dividend stocks for passive income

- staples for stability and consistency

At first glance, it looked like another welcomed clone of a stock newsletter, however, their layout and content seemed well researched and refreshing.

Why I Decided to Test 5StarsStocks.com

Here’s the situation: I’m familiar with dozens of “expert” stock sites that promise a lot and deliver a little. Some provide a hint of authority, throwing out terms like “AI,” or “the metaverse,” suggesting that they themselves know what they are talking about.

But 5StarsStocks.com piqued my interest because it seemed grounded—less hype and more explanation. They didn’t just say “buy this”; they explained why they liked each pick.

So for the sake of both my curiosity and my investment ego, I decided to follow their picks for 30 days—real money, real results.

But was it risky? A little.

Was it fun? For sure.

Was it worth it? Let’s find out.

Setting Up My Test Portfolio

Before I started clicking stocks, I decided to pick five of their top picks across categories:

- One tech/AI stock based on a 5StarsStocks.com AI pick.

- One 3D printing stock based on their innovation list.

- One “value” stock that they said was undervalued but ready to pop.

- One dividend stock with a stable yield.

- And one that I found in their 5StarsStocks.com staples section—something safe and boring (because balance, right?).

I committed $1,000 in each pick, followed the picks every day, and kept a price monitoring journal noting price changes, updates, and my emotions (answer: lots of coffee and refreshing my charts 😅).

Week 1: The Rollercoaster Begins

The experience of the first week was like being in a suspense movie – with excitement and anxiety.

The AI stock that I purchased was up 8% in the first three days. Not bad! And then BOOM, after a crazy overnight tech sector sell-off, I lose 6%. Classic

The 5StarsStocks.com dividend stock, in contrast, didn’t move at all. I suppose that’s the point as I collect a dividend in the middle of the week. Not sexy, but having reliable income is nice.

The 3D printing stock was still bouncing around (it’s about as stable as a caffeine buzz at 8 AM); however, the value stock (still dull as moist cardboard) stayed stable. Sometimes, boring is beautiful.

Week 2: The surprises start

By the end of the second week, you could see some trends emerging.

- The 5StarsStocks.com AI recommendation began to stabilize as it started to recover from early losses.

- The dividend stock had a subtle 3% increase.

- My 3D printing recommendation went on a totally random 12% rally after significantly beating earnings (I may or may not have done a quick happy dance).

That is when I realized, these 5StarsStocks.com recommendations had some serious data backing them up, rather than gut instinct.

Their commentary about growth potential and momentum within a sector started connecting the dots for me.

Week 3: My Confidence Kicked In (Maybe Too Much 😏)

At that time, I felt a little too sure of myself. Every stock was green, except for one lagging staples stock that would not budge.

So what did I do? I bought more of the AI stock. (Yes, I realize this is an amateur move)

The market made me pay for it quickly. The tech stocks, like the AI stock, dropped sharp mid-week and erased close to half of the gains from zip. Lesson learned: stick to the plan, not the emotions.

Still, generally speaking, my 5StarsStocks.com passive stocks choices continued to hold value. This was particularly true for the dividend plays and stocks with inherent value.

Week 4: The Final Tally

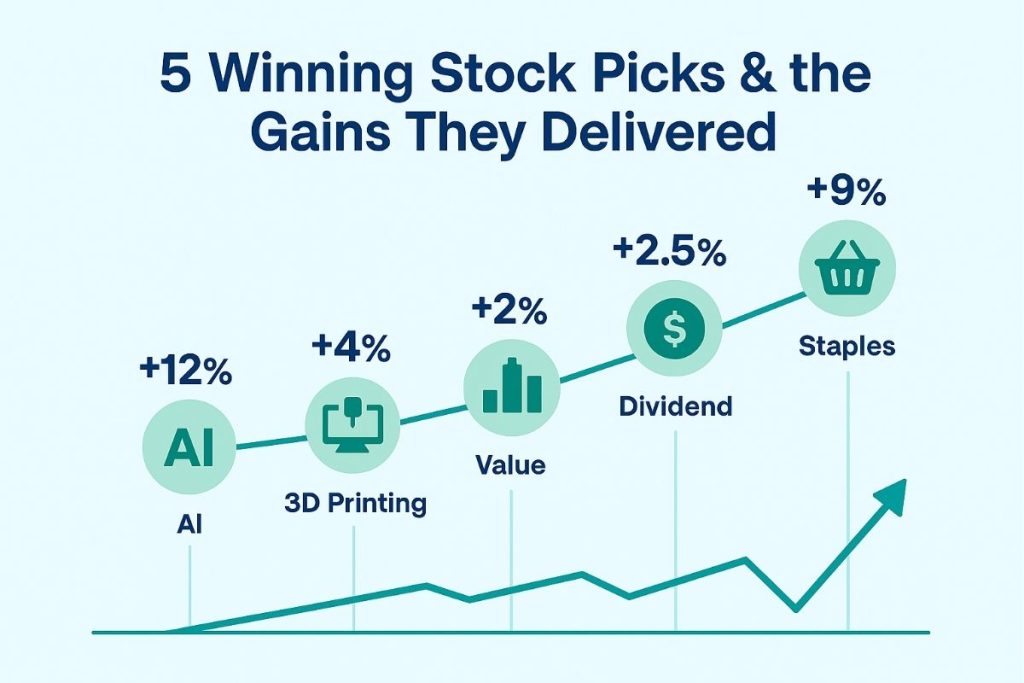

After a full month, here’s how my little experiment ended:

| Stock Type | Category | Gain/Loss % | Notes |

|---|---|---|---|

| AI Stock | 5StarsStocks.com AI | +5.8% | Rebounded after volatility |

| 3D Printing | 5StarsStocks.com 3D printing stocks | +12.3% | Surprise performer! |

| Value Stock | 5StarsStocks.com value stocks | +4.1% | Slow but steady |

| Dividend Stock | 5StarsStocks.com dividend stocks | +2.5% | Plus quarterly payout |

| Staples | 5StarsStocks.com staples | +0.3% | Stable but dull |

Total gain: ~5% in a month.

Not bad at all, considering I didn’t do any heavy analysis myself. It wasn’t some get-rich-quick miracle—but it definitely beat the average savings account.

What I Liked About 5StarsStocks.com

Alright, credit where it’s due—they did a few things really well.

1. Straightforward Insights

They didn’t drown me in jargon or charts. Each pick came with a short breakdown—why it’s promising, potential risks, and upcoming catalysts.

2. Balanced Portfolio Options

Instead of just hyping AI or tech, 5StarsStocks.com included value, dividend, and staple stocks. That mix helped stabilize returns.

3. Transparency

They actually track past performance on their site. Seeing old picks with updated data felt refreshingly honest.

4. Easy to Navigate

The website layout? Clean and modern. No pop-up overload or spammy banners. IMO, user-experience alone makes it worth checking out.

I appreciated about 5StarsStocks.com

Lets give credit where credit is due: they did some things well!

1) Easy-to-read insights:

They did not bombard me with complicated terminology or charts. For each pick, they provided a 2-3 sentence write up of the -whys of the pick, catalysts coming up, and potential risks.

2) Balanced picks.

5StarsStocks.com did not only pick AI or high flying tech stocks. 5StarsStocks also picked handfuls of Bob’s of value, dividends, and regular ol’ staple stocks to stabilize return.

3) Transparency:

They actually track previous performance on their site. I liked seeing previous picks along with the updated data. I found this level of transparency refreshing and honest.

4) Simple layout:

The layout was modern and it did not have excessive pop-ups/offers or spammy looking banners. At least the user experience alone was enough for me to keep coming back to watch the stocks and investments.

What I’d like to see improved;

Of course, it is not perfect and there’s some room for improvement:

- Limited depth: Some reports could’ve been deeper free of general finance jargon the same as a dividend savings stock.

- No alerts or portfolio track – I was manually tracking everything and that was ok for me, many traders and investors like portfolios all tracked and automatic alerts to determine when to buy or sell..

- Short time frame bias – Some picks were just look good recommendations, others had a slight bias toward momentum trades. I like momentum investments when I’d like to take downside risks, stick with those stocks for at least until some time frame passes.

- Of course, enabling everyday traders is a great service, and some of these are nuances that may even be me being a bit picky and trivial.

What I Learned from the Experiment

I learned several valuable lessons from my experience with 5StarsStocks.com—some related to investing, others related to my own behavior.

- First off, emotion kills returns. I overreacted to dips on more than one occasion.

- Diversification works. Dividends and important stocks cushioned some of the volatility.

- Independent research matters. Even when using stock-picking sites, knowing why you’re buying anything is important.

Lastly, and most importantly, having fun with investing does not equal reckless trading.

So… Is 5StarsStocks.com Worth It?

Short answer: Yes, if you use it correctly.

5StarsStocks.com is best for someone who is an investor and:

- wants curated ideas without spending hours researching;

- likes reading accessible, easy-to-read analyses;

- enjoys variety from AI,3-D printing stocks to important dividend or stable stocks;

However, it is not for someone expecting to wake up one day a billionaire following a stock pick, or expecting overnight gains like some dumb Bitcoin craze.

5StarsStocks.com is more like a really good research buddy seeking out some long-shot potential better-than-average winners—not like a crystal ball.

My Honest Take (No Sugarcoating)

I left 5StarsStocks.com after a month of use feeling pleasantly surprised. My portfolio grew modestly and I learned a ton in the meantime.

Do I plan to continue using 5StarsStocks.com? Yeah, actually, especially to identify themes that are emerging such as 5StarsStocks.com “AI” or “value” stock picks that I might otherwise miss.

There is no magic. It’s thoughtful information prepared for an investor looking for a leg up on the market (without the noise.)

If this describes you and you enjoy experimenting, educating yourself on the subject and maybe and a wink of sarcasm while the market is dipping, you’ll probably enjoy it too.

My Final Thoughts in a Nutshell: Lessons from My 1 Month Trial

Quick recap:

- 5% portfolio growth over 30 days? ✅

- No regrets, with a few learning lessons ✅

- Better confidence that mixing their picks with my strategy makes sense ✅

So yes, in summary, 5StarsStocks.com & their picks passed the test. A refreshing blend of logic, variety & readability designed for the average everyday investor who wants to feel informed, without complicated Wall St concepts getting in the way.

Would I recommend it to a friend? Absolutely.

Would I put my whole portfolio in their hands? No.

As a valuable resource in my search for high-value potential ideas or as a resource for balancing a portfolio, it’s a site worth bookmarking.

And hey, even if you do not

TL;DR – My Quick Verdict

- Website: 5StarsStocks.com

- Experience: 30 days of testing their “top picks”

- Results: +5% overall return

- Best feature: Balanced, data-driven picks across multiple sectors

- Downside: Needs better alerts & deeper analysis for pros

- Worth it? IMO, yes. A solid tool for casual and intermediate investors alike.

Final takeaway: 5StarsStocks.com isn’t about hype—it’s about helping you invest smarter, one pick at a time.

✅ Pro Tip:

If you decide to try 5StarsStocks.com, don’t just copy every pick. Use their insights as a starting point, mix them with your own research, and create your own strategy.

Because at the end of the day, even the best stock tips mean nothing without a confident investor behind them. 😉